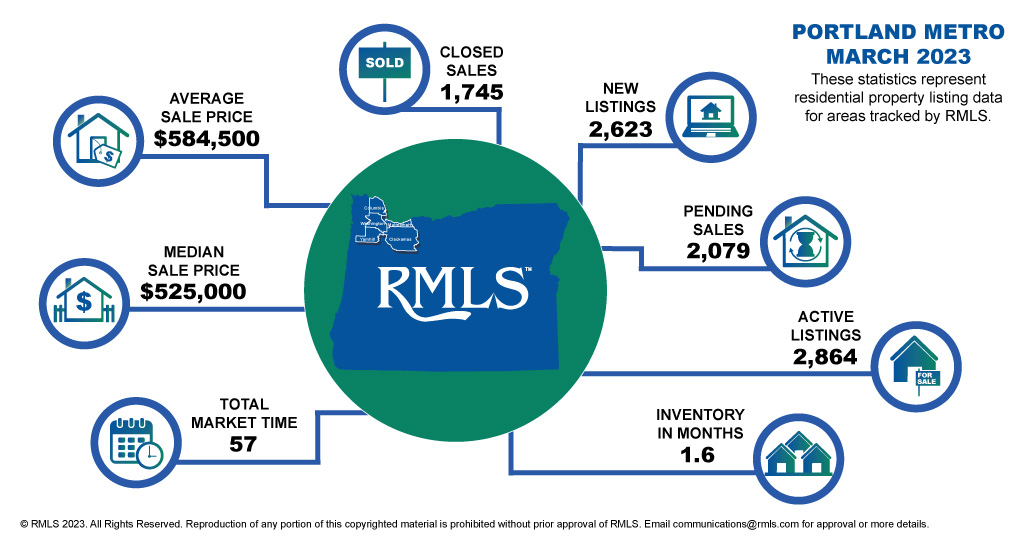

Year-Over-Year Market Breakdown: Sales are down considerably when comparing March 2022 with March 2023. There are a quarter fewer new listings (-25.5%) on the market than this time last year. In addition, pending sales and closed sales are down -31.7% and -35% consecutively from March 2022.

Much of this is due to interest rate increases. Most home sellers refinanced into the lower rates offered last year. If they wanted to sell, they’d be looking at almost doubling their current interest rate. As a result, most home sellers are avoiding the market altogether. The same goes for home buyers facing affordability issues due to the higher rates.

The Opportunity: Most experts agree that we’ve already hit the bottom of the current market slump. March 2023 saw an increase in new listings (+48.7%), pending sales (+22.1%), and closed sales (+21.7%) from February 2023. As inflation continues to decrease and mortgage rates begin to trend downward, more and more buyers and sellers are beginning to interact with the market again. This trend will continue in a larger wave in the latter half of the year.

If you can buy in this small window before the rest of the market returns in masse, you can negotiate things like seller credits or repairs, not have to waive contingencies, or offer an excessive amount of the list price. We are still seeing multiple offers on homes but not at the rate we saw this time last year.

Curious how the current market effects you and your goals? Reach out here and let’s talk shop!